6/5/2025

Fueling Growth and Value Creation through Productivity

Highlights from 2025 Deutsche Bank Global Consumer Conference.

Andre Schulten, Chief Financial Officer, and Shailesh Jejurikar, Chief Operating Officer, presented today at the 2025 Deutsche Bank Global Consumer Conference to share a review of our results, an update on Enterprise markets and how solid execution of P&G’s integrated growth strategy is improving performance.

Sustained Results

P&G’s 2024 fiscal year completed six consecutive years of four percent or better organic sales growth, delivering consistent growth pre-COVID, during the pandemic, across periods of supply chain disruption and inflation challenges and consumption slowdown in key markets.

Fiscal year 2024 was P&G’s eighth consecutive year of two percent or better Core EPS growth — averaging nearly eight percent over that period. Through the first three quarters of the 2025 fiscal year, P&G delivered +3% Core EPS growth — at the mid-point of 2-to-4-percent guidance range for the fiscal year.

We’re continuing our strong track record of cash return to shareowners. Over the first three quarters of fiscal year 2025, P&G has returned more than $13 billion dollars to shareowners through dividends and share repurchases.

In April, P&G announced a five percent increase in its dividend, underscoring the company’s continued commitment to returning cash to shareowners. This marks the 69th consecutive annual dividend increase and the 135th consecutive year the company has paid a dividend.

This is the type of long-term, balanced top- and bottom-line growth P&G strives to deliver with solid, consistent growth over time.

Growth Opportunities

Looking ahead, consumers face greater uncertainty. Competition is fierce. The geopolitical environment is unpredictable. And technology is rapidly transforming nearly every aspect of daily life. At the same time, we can unlock significant growth by better meeting the needs of currently unserved and under-served consumers, expanding into new segments, and growing markets to best-in-class levels.

In North America, we estimate there is up to $5 billion dollars of market potential in our categories simply by growing household penetration of our brands among currently unserved and under-served consumers.

In Europe, driving consumption and growing markets across the region to best-in-class levels — while just maintaining current market share in our existing categories — is more than a $10-billion-dollar opportunity.

Enterprise Markets also have significant opportunity. Driving per capita consumption in our top Enterprise Markets to the levels we currently have in Mexico is a $10-$15-billion-dollar sales opportunity.

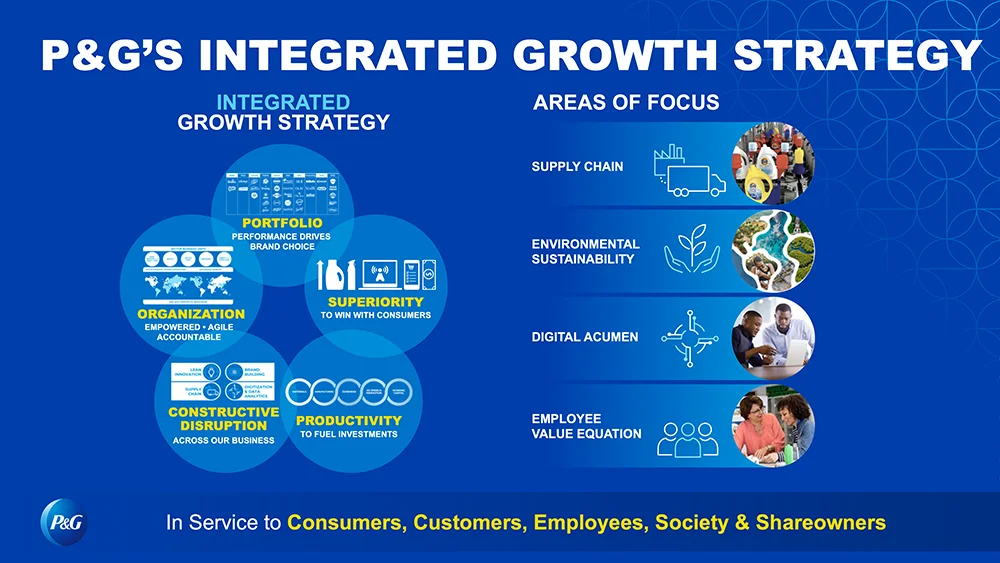

Positioning ourselves to best capture these growth opportunities and manage the increasing near-term challenges benefits from disciplined execution of our integrated growth strategy and even more disciplined resource allocation — human and financial.

Accelerating Productivity

A key element to take advantage of these growth opportunities and mitigate cost challenges is productivity.

To realize the tremendous potential for growth ahead, we are raising the bar on integrated superiority across all vectors, fueled by the next level of productivity.

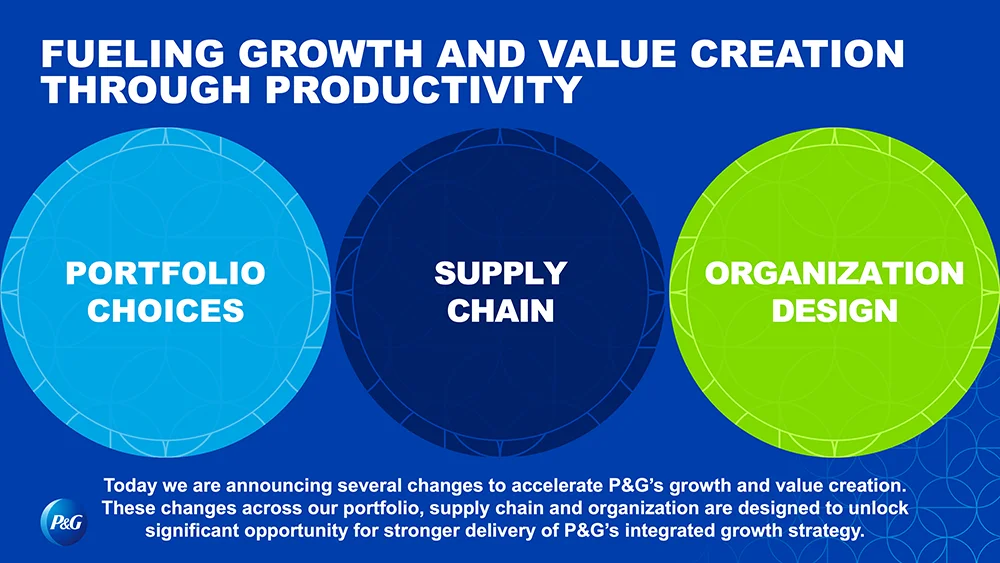

In Fiscal 2026, we’ll begin a 2-year effort to accelerate P&G’s growth and value creation. These changes across our portfolio, supply chain and organization are designed to unlock significant opportunities for stronger delivery of P&G’s integrated growth strategy.

This is not a new approach, rather an intentional acceleration of the current strategy to widen P&G’s margin of advantage in superiority, fueled by productivity, to win in the increasingly challenging environment in which we compete.

There are three main areas of focus: portfolio, supply chain and organization design.

-

The portfolio choices include exits of some categories, brands and product forms in individual markets. They may also include some brand divestitures. More details will be shared in the months ahead.

-

These portfolio moves enable the business to make related interventions in our supply chain — right-sizing and right-locating production to drive efficiencies, faster innovation, cost reduction and even more reliable and resilient supply.

-

Finally, there will be additional changes to ensure an even more agile, empowered and accountable organization design — making roles broader, teams smaller, work more fulfilling and more efficient, including leveraging digitization and automation.

Taken together, each of these actions is intended to widen P&G’s margin of advantage in superiority leading to growth and value creation.

In doing all this, P&G expects to reduce up to 7,000 non-manufacturing roles, or approximately 15 percent of our current non-manufacturing workforce over the next two years. As always, employee separations will be managed with support and respect, and in line with our principles and values and local laws. Specific impacts by region or site are not available at this time.

Plans will be implemented over the next two fiscal years, allowing us appropriately sequence the delivery of important innovation and operational projects. As we do this, our top priority remains delivering balanced growth and value creation to delight consumers, customers, employees, society and shareowners alike.